“Single best gift congress has ever presented to the American taxpayer.”

“Build retirement accounts over the long-haul to incredible size.”

“Remain free of income tax forever.”

– Ed Slott – IRA Expert and NYT Best Selling Author

There are many additional benefits to establishing a Roth IRA over and above the advantages you get with a traditional IRA. With a Roth IRA, you make contributions with money on which you’ve already paid taxes. And you’re able to withdraw your contributions tax- and penalty-free at any time, and for any reason.

Plus, any earnings have the potential to be withdrawn tax-free in retirement, provided certain conditions are met. And there are even greater tax advantages possible by converting your traditional IRA to a Roth.

Roth IRA Basics

- IRA contributions are made on an after-tax basis, with no up-front tax deduction on contributions, BUT Roth IRA

withdrawals are tax-free, - There is NO required minimum distribution with the Roth, unlike traditional IRAs. This means your retirement assets grow free of taxes over time,

- You can contribute new retirement savings past age 70 ½, unlike traditional IRAs, as long as you have earned income.

- You can take Roth IRA contributions tax-free and penalty-free at any time and for any reason, unlike traditional IRAs.

- Even more valuable for estate planning reasons, your beneficiaries can inherit your Roth IRA assets completely tax-free

The Tax-Savings Advantages of a Roth IRA Conversion

Roth IRA investments grow tax-free, which may help you save more money over time to fund your retirement.

Anyone can convert eligible IRA assets to a Roth IRA regardless of your annual income, marital status, or account balance.

Assets converted to a Roth IRA must remain there at least 5 years to avoid penalties and taxes, but distributions are tax-free and penalty-free after that.

Think of a Roth conversion as modifying your account from being taxed later, perhaps at much higher tax rates in the future, to taxed now at rates that are the lowest in decades.

Tax Benefits of a Back-Door Roth.

Did you know that you can make a non-deductible contribution to a traditional IRA, then immediately convert those assets to a Roth IRA tax-free? Yes, it’s possible because you did not receive a tax deduction on your traditional IRA contribution.

This is a recurring tax savings and retirement planning strategy you can repeat over and over, year after year.

Before taking full advantage of the backdoor Roth IRA conversion, consider rolling your traditional IRA assets and/or 401k assets into a Roth IRA first, then take advantage of the back-door Roth every year after.

Is a Roth IRA Conversion Right for Me?

The three most import factors for you to consider when converting traditional IRA assets to a Roth IRA are costs, your retirement time horizon and especially taxes.

In fact, there may never be a better time to convert your traditional IRA into a Roth IRA than right now. When tax-deferred IRA savings accounts were created in 1971, the top marginal tax rate was a whopping 70%. Today, the top tax rate is just 37%, the lowest in our lifetime.

And there’s an income tax time bomb lurking just a few years from now.

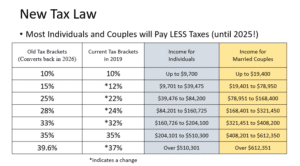

President Trump’s Tax Cuts and Jobs Act made corporate tax rate changes permanent, BUT the new, lower individual tax rates are set to expire and revert to higher rates in just over five years from now, as you can see in the table above.

The IRA Myth:

Most folks believe they will be in a lower tax bracket during their retirement years, but that may NOT be the case with income tax rates at generational lows right now, and America’s fiscal deficits and national debt at all-time highs.

In a traditional IRA you get a tax deduction upfront and your savings compound tax-deferred over time, but eventually you must pay ordinary income tax, as high as 37% currently, on a much larger amount of money when taking distributions.

With a Roth IRA by contrast, you’ve already paid tax upfront, so all your contributions and all your growth in earnings are tax free forever after.

The difference can be staggering over a long period of time due to the power of compounding. A $500,000 IRA growing at just 7% per year will double in value roughly every ten years.

- Over 10 years your IRA assets grow to $1,000,000, and your tax burden at the top 37% rate is now $370,000.

- And over 20 years your IRA assets grow to $2,000,000, but your tax burden also doubles to $740,000!

With required minimum distributions at age 70 ½, you must withdraw a set amount from a traditional IRA whether you need the money or not, potentially forcing you into a higher tax bracket. Required minimum distributions can also cause your Social Security income to be taxed, plus create a surcharge on any Medicare benefits you receive.

That’s why a Roth IRA is often the best solution that can make you wealthier over the long run by paying taxes sooner rather than later!

The key advantages of converting now to a Roth IRA:

Accumulate a Larger IRA

A Roth IRA is worth more than a traditional IRA, because you’ll never pay a dime in taxes when you withdraw your money, including your compound earnings, unlike a traditional IRA, where your distributions are fully taxed.

Avoid Minimum Distributions

Unlike a traditional IRA, you won’t be forced to take distributions you don’t need. Your Roth IRA investments grow tax free as long as you wish.

Reduce Estate Tax

Estate tax applies to both traditional and Roth IRA assets, but in a Roth IRA, both you and your heirs get to keep ALL the money they withdraw tax free.

Shift Your Tax Rate

If you convert to a Roth IRA now, you’ll pay tax at historically low rates. And when you take your money out later, you won’t pay any taxes at all.

Flexibility

Just five years after a Roth conversion, you can withdraw the conversion amount, plus regular contributions, without paying any tax or penalty even though you’re still under age 59½.

When you add it all up, there are many tax-saving and wealth-building advantages to a Roth IRA conversion. To learn more and see if a Roth conversion is in your best interest, contact TSP Family Office now to arrange a free consultation by calling (772) 257-7888.

;)

;)

;)

;)