Many businessmen, and their accountants, are still getting used to the sweeping tax law changes introduced in President Trump’s Tax Cuts and Jobs Act (TCJA) that went into effect in 2018. But it’s never too early to get a jump on tax savings moves you can make now, before year end.

After all, it’s always good to get an early start on saving money. Here are a two especially powerful tax saving strategies to consider right now, before the holidays are on top of us, that will help you keep more of what you earn in your pocket.

#1: Reap a tax savings harvest

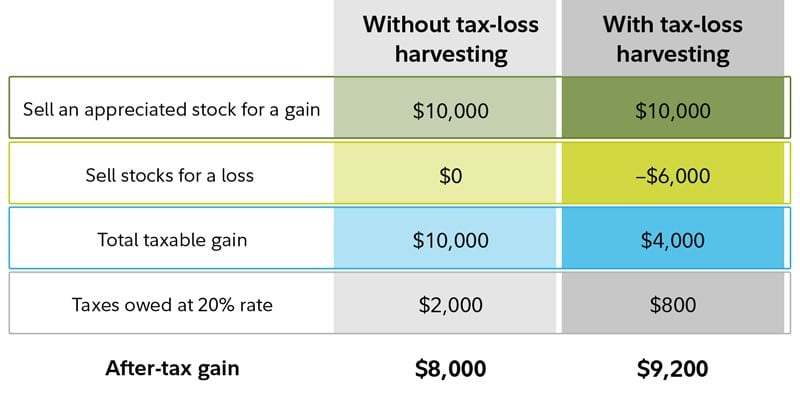

2020 has been a ROUGH year, no two ways about it. It’s been a difficult time for American’s health and for society as a whole. It’s been rough on many businesses both large and small. And it’s been a tough year for the stock market, which has swung wildly both up and down in 2020. But if stock market volatility this year has led you to take some losses in your investment portfolio, the silver lining is that you can harvest those losses to save big money on your taxes.

An investment loss can be used for 2 different things:

- The losses can be used to offset investment gains

- The losses can offset $3,000 of income on a joint tax return each year. And unused losses can be carried forward indefinitely

There are 2 types of gains and losses: Short-term and long-term.

- Short-term capital gains and losses are those realized from the sale of investments that you have owned for 1 year or less.

- Long-term capital gains and losses are realized after selling investments held longer than 1 year.

The key difference between short- and long-term gains is the rate at which they are taxed.

Short-term capital gains are taxed at your marginal tax rate as ordinary income. The top marginal federal tax rate on ordinary income is 37%.

But for long-term capital gains, the capital-gains tax rate applies, and it’s significantly lower, ranging from zero up to a maximum of 20%.

According to the IRS, short- and long-term losses must be used first to offset gains of the same type. But if your losses of one type exceed your gains of the same type, then you can apply the excess to the other type.

Fo r example, if you were to sell a long-term investment at a $15,000 loss but had only $5,000 in long-term gains for the year, you could apply the remaining $10,000 in losses to any short-term gains you have.

r example, if you were to sell a long-term investment at a $15,000 loss but had only $5,000 in long-term gains for the year, you could apply the remaining $10,000 in losses to any short-term gains you have.

Also, keep in mind that realizing a capital loss can be effective even if you didn’t realize capital gains this year, thanks to the carryover provisions for capital losses. The tax code allows you to apply up to $3,000 a year in capital losses to reduce your ordinary income, which is taxed at the same rate as short-term capital gains.

Make tax-loss harvesting part of your year-round tax planning and investing strategies, but make your moves before year-end to maximize this valuable tax saving deduction.

#2: Consider converting your IRA

We covered the Roth IRA conversion strategy in detail in a previous article. But this can be such a powerful tax savings strategy that it’s worth going over again before year end.

Recall that the TCJA lowered tax rates and changed the income thresholds for different tax brackets. But remember, those changes are set to expire in 2025. So if you saved a lot of money in a traditional IRA or 401k, you may be able to lock in today’s lower tax rates by converting part, or all, of your savings into Roth IRA accounts.

Because you pay taxes on the amount of money you convert into a Roth up front, rather than when you withdraw money as with a traditional IRA, you’ll owe ZERO taxes on future earnings as long as your withdrawals are qualified. If you believe that your future tax rates may go up, either because of tax law changes or because you expect your future income to increase, then a Roth conversion could save you money.

One strategy is to convert up to the limit of your tax bracket. For example, in 2019, a couple with taxable income of $125,000 would have a 22% marginal tax bracket (which tops out at $168,400). So, they could convert up to $43,400 to a Roth before maxing out of the 22% bracket.

When it comes to tax-advantaged savings vehicles, there aren’t many at your disposal these days to help you cut your tax bill, so take full advantage of every one of them.

This includes contributions to your traditional 401(k), 403(b), or similar workplace retirement plan, which reduce your current year taxes. The current contribution limit is $19,500, but if you’re over 50 you can contribute an extra $6,500, for a maximum contribution of $26,000. Be sure to act quickly if you want to contribute more to your workplace savings plan.

Also, be sure to maximize contributions to your personal health savings account (HSA) to help reduce your tax bill even more.

Bottom line: In the rush to get things done by year-end, now less than two months away, don’t forget to maximize these important tax savings strategies. Right now is a great time to look into these potential deductions. Remember, tax planning is not a one-and-done year-end exercise. To help reduce your taxes, it makes sense to be planning throughout the year. Need help with that? TSP Family Office can help you build a tax-smart investing plan that works for you and aims to take full advantage of these, and many other year-round tax saving strategies. To learn more, call us at (772) 257-7888.

;)

;)