The world has just suffered a sudden stop in economic activity unlike anything that’s ever been seen before due to the COVID-19 virus outbreak. With America now the global epicenter of the outbreak, and US infections still expected to rise, both business and social activity has come to almost a complete standstill.

The world has just suffered a sudden stop in economic activity unlike anything that’s ever been seen before due to the COVID-19 virus outbreak. With America now the global epicenter of the outbreak, and US infections still expected to rise, both business and social activity has come to almost a complete standstill.

Schools and many businesses are closed with education and commerce operating remotely (distance learning, working remotely) as every American becomes highly skilled in the art of social distancing and working from home.

The virus is taking a huge toll on the health of Americans in every part of the nation, and on the health of the U.S. economy too, which has nearly ground to a halt. Although this health crisis is a uniquely unusual, not to mention a frightening, situation, it’s not entirely unprecedented. And important lessons from the past can be applied to help you survive this crisis and thrive afterward.

For instance, Asian nations have previously dealt with health crises like the Hong Kong flu and SARS in the recent past which severely disrupted their societies and economies, before they quickly recovered and prospered again.

And although the US hasn’t faced a health crisis of this magnitude in more than a century, there have been similar disruptive events in recent decades that did inflect serious, but temporary, damage to American society and our economy: The 911 terrorist attacks in 2001, and the Great Recession and financial crisis during 2007-2008 offer two similar examples to the current crisis.

American society and businesses not only recovered but thrived again after these past events, and this too shall pass. We will rise above the challenges we face and be stronger and better than we were before.

There are of course many differences between what Americans face right now and what happened in past episodes of national crisis and economic stress, but there are also key similarities in the way those events shaped our society and impacted American businesses and the broader economy.

The lessons learned from those prior events can help shed some light on the sectors of our economy and types of businesses that are best positioned to not only survive this current crisis, but thrive once the crisis has passed. Let’s take a closer look.

Lessons Learned from 911 and Similarities with Today

The swift and sharp impact on American society and business is the main similarity between the 911 terror attacks and the COVID-19 virus outbreak we face in 2020.

Both of these events fit the definition of a classical “black swan” event, in that both events were unexpected, which means by definition, that Americans weren’t able to prepare in advance for the fallout from either of these events.

In the aftermath of 911, the impact on American society and business was swift and severe, very similar to our experience with the virus outbreak in recent weeks.

The U.S. economy was already in a recession during September 2001 in the wake of the dot.com stock market bubble which had burst in 2000. But the events of 911 dealt a sharp additional blow to the confidence of American society and business activity, further weakening the U.S. economy and likely prolonging the recession.

911 was also a black swan event that dealt an immediate and severe blow to financial markets, similar to the virus outbreak today.

The New York Stock Exchange and other financial markets were closed for four days in the aftermath of the 911 attack, which was the longest closure of financial markets since 1933! When the stock market finally did reopen the following week, the Dow Jones Industrial Average fell a then-record 1,370 points or -14% in a single week. U.S. stocks have suffered similar steep and swift declines in the past several weeks.

Businesses that were hardest hit after 911 included: Airlines, travel & tourism, and financial and insurance companies, similar to today. Recall that air travel was grounded in the U.S. in the immediate aftermath of 911 which hurt the airlines the most, but also triggered a domino effect that impacted many other travel and tourism related businesses. And it took quite some time for air travel to rebound to more normal pre-911 levels.

In the aftermath of 911, American Airlines stock price dropped 39% and United Airlines shares fell 42% in value. Similar steep declines hit travel, tourism, hospitality, entertainment and financial services businesses as a wave of temporary fear and uncertainty swept through the nation.

Among the financial services giants with the steepest drops in share prices after 911—Merrill Lynch lost 11.5%, and Morgan Stanley lost 13%.

Insurance firms reportedly paid out some $40.2 billion in insured claims related to the 9/11 attacks. Among the biggest losers was Warren Buffet’s Berkshire Hathaway. Most insurance firms subsequently dropped terrorist coverage. But most insurers survived the 9/11 fallout since they held adequate cash reserves to cover these obligations.

This episode is very similar to what businesses face today in the wake of the virus outbreak.

Air travel has been severely curtailed for weeks and is not likely to quickly bounce back to “normal.” United Airlines, for example, cut about 80% of its capacity in April with even larger cuts expected in May. The already ailing airline said it is losing more than $100 million a day in revenue as a result. And Southwest Airlines cut 2,000 flights per day, or half it’s normal schedule, for the months of May and June.

Industry wide, U.S. airline traffic has plunged to 150,000 passengers flying nationwide on any given day compared with normal loads of more than 2.2 million passengers per day!

Predictably, a similar domino effect is taking place right now across many travel & tourism businesses nationwide. Leading hotel chains and online travel services have reported a steep decline in revenues and bookings. Theme parks, sports stadiums and entertainment venues are empty nationwide; malls and office buildings are closed.

During the current virus outbreak, airline and other travel related businesses have been hurt much worse than after 911. American Airlines stock price fell 67% during the first quarter of 2020, and United Airlines shares dropped 75% in value.

Insurance and financial stocks have likewise been hit even harder than after 911. The KBW US Bank Index declined over 40% during the first quarter of 2020, and the Dow Jones US Insurance Index fell 45%. Both represent much larger losses than the hits to those businesses taken in 2001.

The 911 experience also brought about permanent changes in the travel industry. Just think about the creation of the Transportation Security Administration (TSA) in 2001 and the impact that beefed up security at airports and cruise ship terminals has had on American travelers.

In the current crisis, the travel industry is likewise expected to be impacted for some time to come. Some have advocated for more strict health-screening protocols to be put in place for airline and cruise passengers, similar to airport security measures put in place post-911. These protocols are very likely to be an added burden on the American travel and tourism industry in the aftermath of the current health crisis.

However, don’t forget that other businesses didn’t just survive 911 but prospered in the aftermath, just as some are expected to benefit from the current crisis.

Certain technology businesses for example didn’t miss a beat after 911 and are similarly well positioned today to thrive as a result of today’s crisis. Technology software and service firms, internet content providers and online teleconferencing businesses are poised to see strong revenue gains from the current crisis.

In 2001, defense contracting businesses, saw prices for their shares increase substantially, anticipating a boost in government spending as the country prepared for the long war on terror. Today, select industrial businesses could profit from increased infrastructure spending which has been proposed as fiscal stimulus measures by Washington.

Also, in the aftermath of 911, telecommunications, entertainment and broadcasting businesses performed very well as did health care and pharmaceutical firms.

Today, telecom businesses and online entertainment are once again prospering as millions of Americans stay at home to watch Netflix and stay in touch with loved ones via video chat on the internet from their laptops, tablets and smartphones.

Health care businesses, including drug companies, health care providers, distributors and medical device companies are very well positioned to benefit even more from the current crisis, since these are the companies which will develop and produce vaccines, medical equipment and supplies to help defeat the virus in America.

The U.S. economy is legendary for its strength and resilience, and the American character is persistently optimistic. No more than one month after the terror attacks in September 2001, the Dow Jones Industrial Average, Nasdaq and S&P 500 Index had regained their pre-9/11 price levels.

However, U.S. stock prices remained in a downward trend throughout 2002 before rebounding in 2003. Likewise, American businesses continued to suffer through recession in 2002 before the economy began recovering again.

Lessons Learned from the Great Recession and Similarities with Today

The Great Recession of 2007-08 was not a sudden-stop event, although the sheer magnitude and swiftness of the business downturn was unexpected by most Americans.

Recall that the recession was brought about by another bubble, not in technology, but this time as a result of real estate speculation during the mid-2000s.

Wall Street, always happy to accommodate any sort of excesses in the U.S. economy, was complicit in making the housing crisis much worse by creating complex derivative securities tied to real estate mortgages and other difficult-to-understand financial products.

When the U.S. real estate market finally slumped, these financials derivates helped trigger a much more severe housing and financial bust than would have been expected. Ultimately, it led to a systemic financial crisis that nearly destroyed the U.S. financial sector.

And, because the housing industry and related businesses both large and small are such an important contributor to the overall economy, the housing bust led to a nationwide recession made worse by the overleveraged financial sector. In the end, large U.S. banks had to be bailed out and recapitalized by Washington before the recession ran its course with businesses not recovering until 2009.

Today, by contrast, the U.S. is not as over leveraged as it was in 2008, although government debt is at an all time high. The U.S. economy had been expanding for over a decade when the COVID-19 virus brought business activity to a screeching halt in a matter of weeks, unlike the more drawn out recessions that took place around 911 or in the aftermath of the 2008 financial crisis.

The good news here is that business activity stopped very quickly in response to this virus, and it’s reasonable to believe that activity will pick up quickly again once the current health crisis subsides.

Once again, there are clear business winners and losers as a result of the current crisis.

Similar to 911, the travel and tourism industry has been hit particularly hard by the current virus. Airlines, cruise operators, hotels and other tourism related businesses, as noted above, have suffered major disruptions and significantly lost sales. Industrial manufacturing businesses have also been forced to either shut down or cut back significantly on their operations. Many non-essential retail stores and restaurants are either closed or operating at drastically reduced business hours.

Many of these businesses now seek government support as a lifeline to bridge today’s crisis. And even after the immediate health scare passes, Americans may not quickly return to travel-as-usual activities. Precautionary social distancing may remain the norm for quite some time.

Still, the economic fallout from the current crisis is different than what is typically seen during other recessions, and different from the path taken during the 2001 and 2008 recessions. There is also good reason to believe that U.S. business can bounce back quicker this time that in the past.

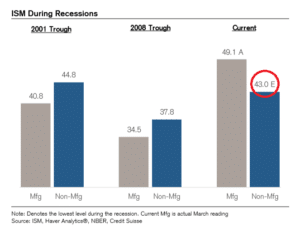

In many prior recessions, such as 2001 and 2008, manufacturing and industrial business activity usually declines more than service sector businesses, as you can see at left and center of the graph below.

This graph shows the ISM manufacturing and non-manufacturing (service sector) business activity during the 2001 recession (far left) and 2008 economic contraction (center). Notice that readings on manufacturing business activity fell more sharply than for service sector businesses, as is typically the case.

But at far right also note that during the current business downturn it’s been just the opposite, with service businesses declining at a faster rate than industry. This makes sense when you think about it because of the abrupt shutdowns in effect for service sector businesses, both large and small, nationwide (think retail stores, restaurants, travel & tourism businesses).

The silver lining to this scenario is the fact that most service-related businesses can quickly restart once such strict social distancing priorities are no longer required. A retail store or restaurant can reopen for business much faster than a General Motors factory for example.

And that means the length and depth of the current business downturn could very well be shallower and shorter than is typical during past recessions, with a quicker and faster recovery period as well.

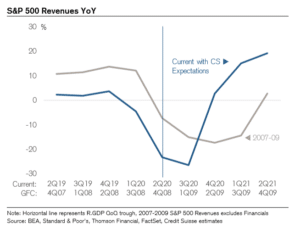

In fact, many economists agree that this downturn could very well be more V-shaped than recessions of the past, as shown in the graph to the right. This graph compares the 2007-2009 recession (grey line) with estimates of the current downturn (blue line) from Credit Suisse research.

As you can see, temporarily lost sales and profits can quickly be made up just as soon as businesses (especially service sector firms) are allowed to resume normal operations once again.

If these forecasts prove correct, the rebound in business could be just as rapid as the decline. The U.S. economy could return to “normal” in a matter of a few months, rather than the longer time it took for the rebound to take hold back in 2009.

Bottom line: We’re certainly not yet at that point where America can open for business once again, but that time may not be as far off as many fear. Right now, we all hope and pray that the “curve will flatten,” meaning less virus infections. It may not be back to business as usual soon, but when the virus is contained many service businesses can get quickly get back to work.

Among the biggest beneficiaries are likely to be restaurant and retail chains that are now closed but can quickly reopen. Think of big, national brand businesses like Starbucks, Chipotle Grill, TJ Maxx and Nike, which should be able to quickly rebound.

Likewise, your preferred local pizza place or your favorite bar & grill should be back in business soon after health care concerns pass.

Meanwhile, technology-oriented businesses like Microsoft, Amazon.com and Google are less likely to see large sales or profit declines, since the technology services they provide are still in high demand. Other companies like Netflix and Comcast, not to mention Amazon Prime home delivery, may actually benefit from a boost in business while we’re all staying home.

At TSP Family Office we wish you, your families and businesses the all the best during these trying times. Stay safe by staying home. We have worked with thousands of clients over the past 18 years to help them save money for themselves and their businesses, and rest assured, we’re here to help you get back to business as usual just as soon as possible. If you have any questions or concerns, please contact us at (772) 257-7888.