Recently Tax Savings Professionals had the opportunity to present a roundtable webcast: Current State of Affairs: Strategies for a Successful Tomorrow. Below is an edited transcript of this far ranging conversation about urgent topics many folks are concerned about today. Led by our own Ted Zamerski, CPA/PFS, CFA, CGMA, the conversation also features Brian Shey, Licensed Insurance Representative and member of your Family Office team; David Babinski, a Business Consultant and member of your Family Office Team; and Paul Haven, a Commercial Banking industry expert.

In this timely event they discuss:

- The importance of reviewing your overall life plan annually;

- Opportunities in the low interest rate environment;

- Opportunities stemming from real or perceived changes in legislation; and

- The importance of using forward-thinking and strategic planning to maximize after-tax income in retirement.

We believe you’ll find this edited transcript of the event to be of interest; enjoy.

Ted: Let’s start with some of the biggest concerns you are hearing from clients right now.

Brian: COVID created plenty of fear, and uncertainty. That has subsided now. Many business owners I know, such as physicians and dentists decided, hey, I was planning on retiring in five years. Why not do it today? Think about the opportunities that are out there now. There have been a number of business acquisitions, a lot of clients are looking to grow. It has also been a very good time to review your own financial planning and retirement goals and strategies for achieving it.

David: I would agree with what Brian said. The new normal is upon us. Businesses are reopening again, clients, customers are coming back, and employees are returning. The focus now lies on what’s ahead, but I will add, it’s also a time to pause and reevaluate other things. There is a lot of cash flooding the system. Deals are being done.

People are selling their businesses. The deals are there because the money, the financing, is there. Many of my clients are reconsidering their goals. Rather than waiting to retire at 67, why not consider retirement at 63 instead? Retirement isn’t some future concept in the far-off distance. Many clients are bringing retirement planning closer into focus rather than considering it an event in the distant future.

Paul: Reevaluation has been a focus for most people recently. And if it hasn’t been your focus, it needs to be. Consider what’s the best business model to put in place given this new environment we are living in, and what lies ahead of us. The Housing market continues to be robust, which is a good indicator that people are still confident with the economy.

The other thing people are focused on right now is how to conserve and create cash, and that is a very crucial detail going forward for businesses that want to survive in this new normal.

Ted: One of the points we want to cover today is the importance of reviewing your overall life plan annually or in some cases starting to put together your first real plan. Just because the environment is changing rapidly, that doesn’t necessarily mean your financial goals need to be changing. Can you speak to that David?

David: Your goals don’t necessarily change, but the priority of your goals may change more than your overall objectives. We use the analogy of the mountain. As you’re going up the mountain, volatility could be good because you’re adding assets when markets are fluctuating, but when you’re going down the mountain in retirement, those fluctuations start to become a bit more painful. So, we do change our philosophy about the way we want to invest.

Sound planning is all about the transition from accumulating wealth while working to distributing wealth during retirement. Market fluctuations become more significant to your financial picture as you move toward the distribution phase. The opportunity here is to reassess your goals in the context of when you do plan on retiring and what expenses you anticipate, such as paying for college tuition, weddings, etc. Depending on where you are in your life, all that needs to be taken into account for managing your goals and priorities.

Ted: Interest rates have dropped in response to the economy slowing. We’ve had a lot of inquiries about refinancing. Mortgage rates rose initially, but they have come back down. Do you see this as an opportunity Paul?

Paul: Now is a great time, with lower rates, to evaluate the details of your personal or business borrowing terms to see if you can earn immediate savings. Fixed rate home mortgage rates are under 3% now. Commercial lending rates are extremely attractive as well. Reevaluate your mortgage to see if it’s worth refinancing, to see if you can find immediate savings, both personally, or professionally for your business.

Don’t be disappointed if you can’t get it done in 45 days or so. It can take 60 days or more to complete the process now because the volume of refinancing is so high right now.

I would start with your existing mortgage holder if you’re looking to refinance an existing loan. That’s often a cheaper and much more cost-effective route. But if you are not offered the right interest rate or terms, start shopping around to your bank or local mortgage broker. Do some homework first, before you call your mortgage company or bank. Be aware of what the current range of interest rates is for the type of property you plan to refinance.

Ted: Brian, we have different styles in how we work with people. Could you talk a little bit about your style and the process you go through in client planning needs?

Brian: The key thing to understand is financial planning isn’t an event, it’s a process that’s always evolving. It’s not something that you draw up on the whiteboard and just check the box when you’ve designed a portfolio. The certified financial planning board designed a seven-step process we use to understand our client’s needs before drawing up the right plan, but that’s just the beginning of this process.

Step seven is monitoring the plan and we’re going to monitor the plan for 10, 20, 30 or 40 years to make certain it stays on track with your goals and keeps meeting your needs as things change.

I’ve always started with the protection component of someone’s plan. It’s very difficult to start with the investment side of it if the foundation of protection is not properly laid first. Start with the important aspect of asset protection first as the foundation of any financial plan. In other words, play good defense. Foundational, defensive moves such as life insurance, disability coverage, plus liability insurance for your home and business, that’s my starting point with clients.

Financial Planning Pyramid:

- Protection first, is the base of your financial planning pyramid

- Then move on to the investments that will fund your financial plan

- Tax planning and finally legacy planning is at the top of the process

Ted: With tax savings in the name of our company it’s a foundation for what we do and where we come from. Brian, how do you link insurance and taxes and how is it used in financial planning?

Brian: From a tax standpoint, we have a lot of conversations about the conventional wisdom of retirement planning. I’m talking about the traditional retirement savings tools: IRAs, 401Ks, Roth IRAs, SIMPLE IRAs, SEP IRAs and so on. All of these products were created by the government and so they make the rules for them. And they can and often do change the rules as time goes on.

Insurance products on the other hand have been around for hundreds of years, long before the government started creating retirement savings tools. So, with properly structured insurance products, we don’t have to play by the government’s rules. A properly designed protection plan can play a significant role in protecting your finances throughout your working years and well into your retirement.

Ted: David, one of the points we want to cover is our ability to combine various touchpoints of expertise as a synchronized team to deliver comprehensive planning. Can you elaborate on how you combine planning efforts, and touch on what unique strategies you use for clients?

David: It’s the collaborative effort of bringing various professionals together that makes a comprehensive financial plan work. The goal is to take money that would otherwise be going to the government, and channel it towards your retirement or legacy planning instead.

A lot of people think of diversification as how much money they have in stocks, how much in bonds, etc. We talk about the concept of tax diversification. How and when your money is taxed along your journey is very important. You need to avoid the eroding effect of annual taxation. That’s were Roth IRA conversions can be a very important tool.

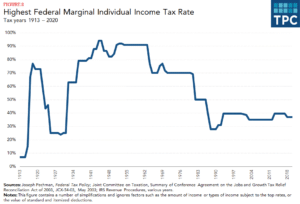

Ted: It’s interesting that a 28% tax rate today is a relatively benign tax rate historically, but it still kills the compounding of your money.

David: When ERISA (Employee Retirement Income Security Act) first came out to create IRAs and such, the highest tax bracket was 70%! So, you were only keeping 30 cents on the dollar with the rest going to the government. That’s why it made a lot of sense to put money away tax deferred in an IRA to get the benefit of compounding that money that should have gone to the government.

30 cents on the dollar with the rest going to the government. That’s why it made a lot of sense to put money away tax deferred in an IRA to get the benefit of compounding that money that should have gone to the government.

Fast forward and today the highest tax bracket is just 37%. We seek to lower your effective tax rate to a lower range of a 20-22% effective tax bracket. These are important strategies to take advantage of because the average tax rate over time has been about 50%. Who knows how much higher tax rates will be in the future? But with so much debt today, tax rates are probably going to move higher from here.

Brian: Government policies have made it much more difficult to transfer wealth within your family. Most people are focused on growing their wealth within their IRA. But you need to be aware of the implications of the Secure Act of 2019. Whenever you are trying to transfer wealth across generational lines, that is where the government really puts their hand out.

The government makes the rules and then they move the goalposts on us whenever they need to generate more tax revenue. When they passed the 2019 Secure Act it specifically targeted beneficiaries that receive an IRA inheritance. This eliminated someone’s ability to stretch their inherited IRA, to take distributions over time and avoid getting hit with a 50% tax up front.

Instead you could take distributions from the inherited IRA over your lifetime. The Secure Act put a 10-year limit on IRAs. You can still take minimum payments for 10 years, but then you must take the entire distribution and be taxed on it. It’s just another example that the government needs money and is tired of waiting.

Ted: David, if people are actively contributing to their IRA it can become a significant amount over time.

David: Brian just talked about the inheritance tax on retirement assets left to beneficiaries. On top of that, people have a false sense of security with regards to the estate tax. Currently it’s $11 million indexed for inflation. I feel that future adjustments to the estate tax rate will be made. I don’t know if that gets lowered to $3 million or $5 million, but the government needs money and people with money have a bullseye on their back for the IRS to come and get it. We are almost certainly looking at future tax rate increases.

If you are making more than $400,000 a year, and if your net worth is over a certain amount, there is a bullseye on your back and they’re unapologetic. They’re coming to take this money. And they can justify it by looking back and saying, the average tax rate has been over 55% since income taxes were put into place, so why are we giving these people a break?

Ted: What impact will future inflation have on financial planning?

Paul: The Federal Reserve has pledged to keep interest rates low for at least the next two years and probably longer. The inevitable result will be that inflation will reappear and, in my opinion, it will be ferocious. Review your personal and business balance sheet with some sense of urgency to make certain what’s needed and what you can do without. The goal is to minimize your debt because cash is king. It gives you a great deal of flexibility and peace of mind.

If your balance sheet is strong enough, consider going to your bank to get a line of credit. Use that to fund your business operations instead of using your own cash. Seek a reasonable line of credit that’s realistic and in line with your business cash flow needs. And do it sooner rather than later. Base your application is based on what amount is justified to meet your business’ needs. You’ll need adequate collateral for the line of credit depending on whether it’s based on inventory, receivables or real estate assets.

Ted: Let’s talk about possible legislative changes that should be of concern to business owners and areas of opportunity you can take advantage of.

David: Roth IRA conversion is one big opportunity. Sure, your CPA may tell you you’re not eligible to contribute to a Roth if you make over $206,000, but recent legislation removed the income cap to convert a traditional IRA to a Roth IRA. Now anyone can convert from a traditional IRA into a Roth, allowing that money to grow tax deferred including your distributions.

Roth conversion is a strategy we talk with clients about on a daily basis. You need to think carefully about how to diversify among your various taxable and tax deferred savings and retirement tools.

Talking about debt and the return of inflation, you’ve got to differentiate between good and bad debt.

Good debt is borrowing that’s backed by appreciating assets like real estate. Your home mortgage for example. If you have good debt at a fixed rate over a long period of time that’s on an appreciating asset like your home or commercial property, then inflation will actually work in your favor.

Paul: I can’t agree with you more, David. Complacency is your biggest enemy right now. Get with experienced advisors now, who can see what’s coming on the horizon and can develop and put in place a sound strategy to help preserve and protect what you’ve worked your whole life for.

Ted: One strategy on a lot of people’s minds right now, specifically if their business was shut down due to COVID, is loss of income. How do you address that?

David: A Roth conversion is a tactical decision to consider to get ahead of a potential increase in taxes. Mathematically, if you’re earning more than the rate of inflation inside your retirement account, you’re better off converting if you believe, as I do, that tax rates are going up. But it’s really a case by case analysis that’s somewhat different with everyone.

Ted: I’m sure a lot of people working with financial advisors are familiar with tax loss harvesting, but what can you tell us about capital gains harvesting?

David: Capital gains harvesting has to do with the new concept of qualified opportunity zones that was recently enacted, where you get tax incentives to develop real estate in certain geographical areas. This is solidly in the tax advantage area because money you invest then grows exempt from future capital gains taxation. In order to participate, you need to have realized capital gains. So rather than looking for losses in a portfolio to offset gains, we are actively looking to generate and realize significant gains, which can come from sales in your investment portfolio, real estate or your business. It’s a fantastic option to consider, but you’ve got to get ahead of it now from a planning viewpoint since we’re already entering the final stretch of the year to make these moves.

Ted: And what are your thoughts on 1031 Exchanges?

David: People are familiar with 1031 Exchanges when they wanted to swap out one real estate property in exchange for another. Exchanges must be a like-for-like transaction in the same ratio of debt to equity. With a qualified opportunity zone you can just invest the capital gain and keep your principle investment working in another 1031 Exchange. It gives you a lot more flexibility.

Ted: Let’s get a quick recap and your final thoughts

Paul: It’s more important than ever not to fall into complacency today. So many things are changing today and will continue to change. Surround yourself with people that you can trust, who are experienced and can help you anticipate what’s on the horizon. Someone who can make complex information easily understandable.

Brian: It’s important to have a second set of eyes to see what you’re doing well from a financial planning perspective and what you should be doing more of that you’ve not been doing. This doesn’t have to be complex. When you are doing this every day, 50 hours a week, the complex becomes pretty simple.

David: The closing thought I have is about our philosophy: Annual tax savings can be multiplied and turned into a real legacy and long-term tax strategies can help to preserve and protect your wealth.

Ted: I can’t emphasize this enough. It’s not just about the planning. More importantly, it’s about execution and constant evaluation. To do this properly it can’t be done on the back of an envelope. We have the solutions you need, but you need to be proactive about prioritizing them and not be reactive to what you hear in the media.

While we may all be anxiously awaiting New Year’s Eve and the beginning of a fresh, new year, we have a unique chance to benefit from the growth and financial opportunities 2020 has presented. The challenge is to identify these opportunities and capitalize on them. ax Saving Professionals can walk you through the steps you can take now – and in the future – to capitalize on today’s unique opportunities. To learn more, call us at (772) 257-7888.