A cost segregation analysis is a powerful way to cut your tax liability and boost your personal or business cash flow. This month let’s revisit this important topic with a real-world case study to illustrate just how valuable this strategy can be.

If you have purchased or remodeled any residential rental or business real estate property in the recent past, or you’re planning to, you’ll want to consider a cost segregation study to find ways to minimize your tax liability and keep more dollars in your business when it comes to depreciating that property.

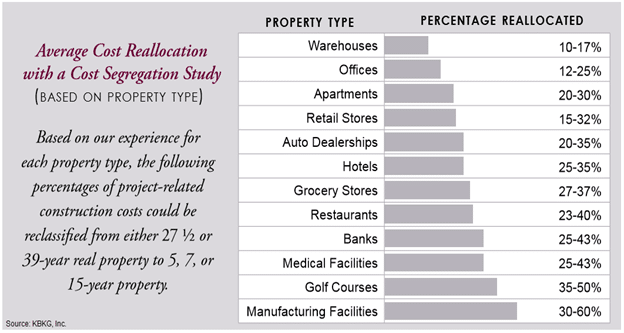

This strategy can be used with virtually every type of commercial (or rental) property; from apartment complexes to industrial buildings, light manufacturing, and office buildings – from restaurants to retail locations to warehouses.

It all starts with a cost segregation study, which according to IRS rules, allows you to allocate or reallocate building costs to tangible personal property in order to accelerate the depreciation deductions, which can dramatically reduce your taxable income.

A cost segregation study will separate your property into four components.

Personal property – The more of this you can legitimately claim, the greater your tax savings will be. The recovery period for personal property, including furniture, window treatments, flooring, business equipment, etc. is just 5-7 years.

Land improvements – This category of assets includes things like fencing, sidewalks, driveways and landscaping and these items have a limited useful life, generally about 15 years.

Buildings – The property can be divided into components so that certain parts, for example a roof that needs to be repaired or replaced, or new electrical wiring or plumbing, can be written off right away, on its own. Although there are separate building components, there is a value to depreciating each component separately.

Land – Land consists of anything not included in the above three categories.

A cost segregation analysis dissects your construction costs that are typically depreciated over 27½ or 39 years. The goal of this analysis is to identify even more construction-related costs that can be depreciated sooner, over 5, 7 and 15 years.

That way you get to claim bigger annual depreciation allowances, which cuts your taxes and puts more money back in your personal or business bank account.

Items such as electrical costs; new carpeting, tile or other floor coverings; new or improved lighting, heating, ventilation and air conditioning systems; upgrades to your building security and monitoring systems; landscaping or paving for the exterior of your property; and other improvements.

These and other building improvements won’t last for the duration of a traditional 39-year depreciation schedule and can be reclassified through a cost segregation study to be depreciated much sooner. And that reduces your tax liability and puts the money right back into your pocket.

The amount of tax savings that you can realize will vary depending on the property type and the improvements you make, but the graph to the right will give you a general idea of the cost savings potential.

Now, let’s take a closer look at a real-world case study that illustrate the tax-saving advantages of cost segregation.

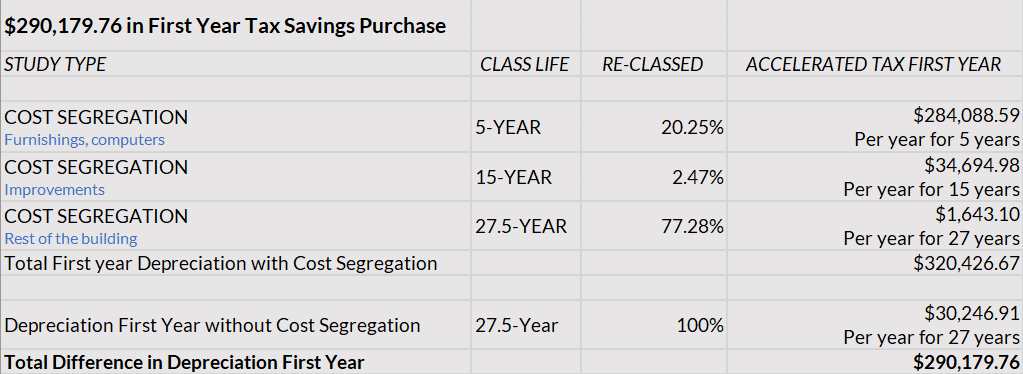

Case Study: A $1.4 Million Apartment Building

Without a cost segregation study and using the standard long-term depreciation schedule, this property would have generated a first-year depreciation of just $30,246.91.

But by applying a cost segregation study, the property owner can accelerate depreciation for year one to $320,426.67. The accelerated deprecation allows the property owner to drastically reduce their tax liability and in turn boost their bottom line.

By breaking down the building asset into components, cost segregation also aids in future benefits of abandonment, repairs, routine maintenance, and overall asset management. Here are the details:

The segregation study provides a detailed engineering review of assets including special purpose mechanical and electrical systems, decorative finishes, site improvements, and any processes related to special purpose construction.

As you can see the savings in terms of reduced tax liability and increased cash flow can be substantial.

What’s the Best Time for a Cost Segregation Analysis? Anytime!

You can benefit from a cost segregation study regardless of the timing of your property purchase or improvements.

The best time to complete a study for new owners is during the year a building is constructed, purchased, or renovated. However, a look-back study can be completed any time after the purchase, remodel, or construction of a property.

In fact, current IRS guidelines make it easy to go back and claim missed depreciation on assets acquired as far back as 1987 without amending prior tax returns. Recently, the CARES Act modified Section 172 of the IRS Code to allow Net Operating Losses (NOLs) generated in tax years beginning after December 31, 2017 and before January 1, 2021 to be carried back to each of the five preceding taxable years.

That means if your business paid federal income taxes from 2013 to 2017, you may be able to go back and claim tax refunds from NOLs in 2018, 2019 or 2020. In other words, a cost segregation analysis on property purchased or renovated even several years ago can reclassify your depreciation of that property retroactively resulting in tax savings.

Finally, if you are in the planning stages of new construction or remodeling a property, it’s a good idea to complete a cost segregation study up-front before the work begins. That way your accountant and contractor can accurately track improvements that qualify for accelerated depreciation, saving you time and money.

Bottom line: A cost segregation analysis can be a powerful and effective tool for reducing your taxes and boosting your personal and business cash flow and is one of the services offered as part of our family office. To find out more about this tax savings strategy, call TSP Family Office at (772) 257-7888 to find out how a cost segregation study could benefit you.

;)

;)

;)