As a business owner, knowing what kinds of ordinary and necessary expenses you can and cannot write off come tax season can be confusing. There are many different ways a business can save on their business expenses, but ensuring that your deductions align with the IRS’s criteria is a crucial part of saving successfully.

While expenses are a necessary part of owning a business, knowing what you should be tracking and planning to deduct is just as important as the documentation itself. From ordinary expenses to necessary expenses and home deductions – knowing what deductions are available is a great way to help ensure your tax strategist has the information they need to maximize your tax savings.

What Can You Deduct?

According to the IRS, a business expense must be both “ordinary and necessary” to be deductible. It defines these two terms differently and states that:

An ordinary expense is one that is common and accepted in your industry. A necessary expense is one that is helpful and appropriate for your trade or business. An expense does not have to be indispensable to be considered necessary.

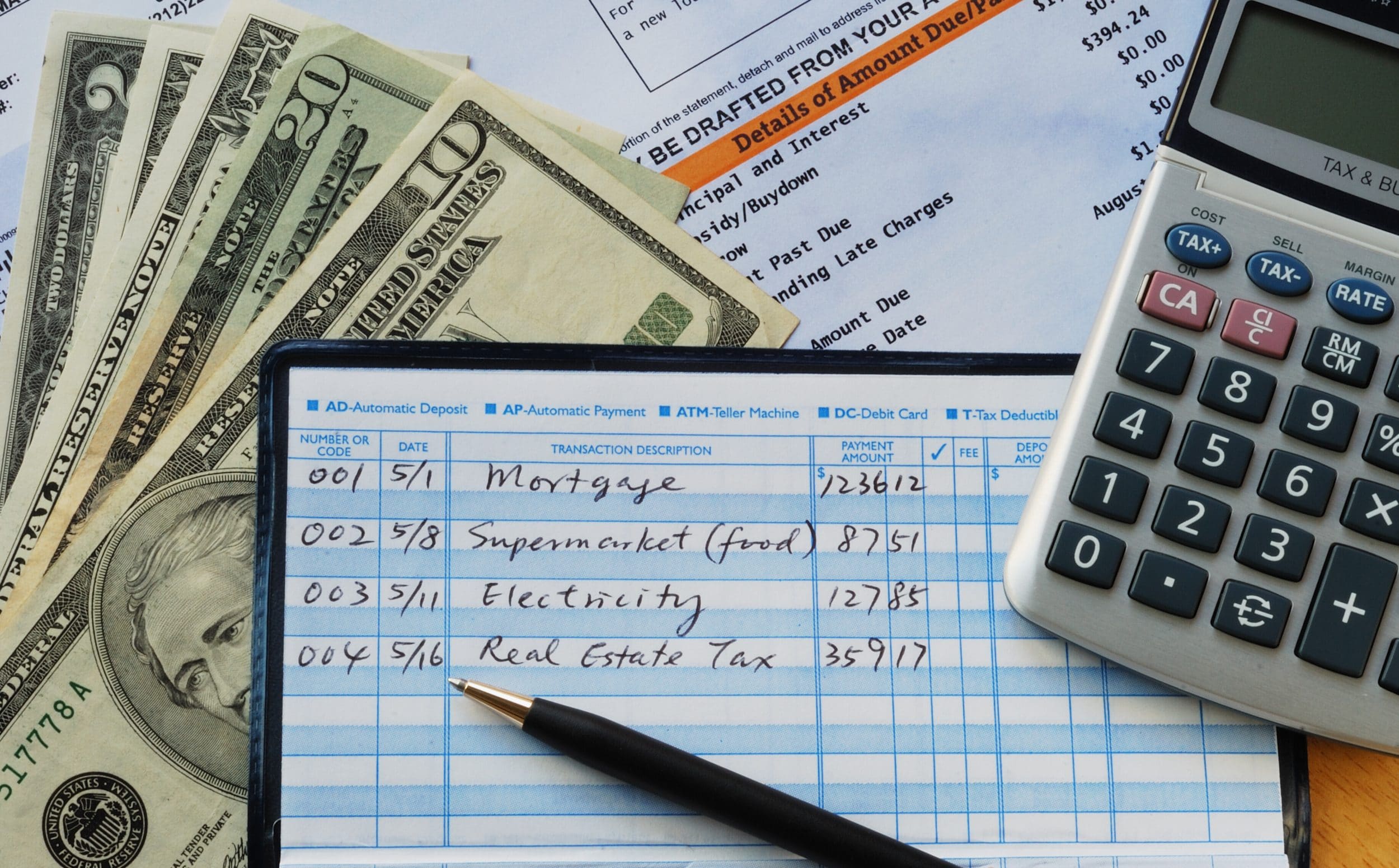

There are some expenses that may be deemed “ordinary and necessary” but are not deductible. These include personal expenses, capital expenses, and expenses used to figure costs of goods sold. Outside of this, if your expense is ordinary and necessary, your tax strategist will likely use it as a deduction at tax time. Therefore, it is important to document and track expenses so you have a detailed record of your deductions at the end of the year.

A few examples of ordinary and necessary expenses include:

- Employees’ wages or salaries

- Employee-sponsored retirement plans

- Insurance held by the business

- Interest expenses on any money borrowed by the business

- Rental expenses for any property leased for business

Partnering with a tax saving professional is a great way to get a customized list of the kinds of expenses you should be tracking and documenting for ultimate tax savings.

Business Owners and their Homes

You can maximize your tax savings by benefiting from the often-overlooked home office deduction. You will want to work with your tax strategist to ensure that you qualify for this deduction and keep detailed documentation of the expenses. The most important way to know if your home office qualifies for this deduction is if you use a part of your home exclusively for business and on a regular basis (any kind of routine usage).

Hire a Tax Strategist for Reassurance

No matter what kind of business you own, partnering with a qualified tax strategist can help you with your overall tax and financial planning throughout the year. An experienced tax expert can ensure you are documenting the necessary expenses while also making sure that you don’t leave any money or deductions on the table. Helping you achieve your largest tax savings possible is exactly what a tax strategist will set out to achieve.

Check out TSP Family Office’s Tax Savings Calculator if you’re new to tax strategies and want to see how much you could save. This is a great way to receive an immediate overview of how implementing a tax strategy alongside a professional can help you stay proactive and save money. Our goal is to help you keep more of what you make so that you can spend it on things you enjoy.

Bottom line: Ordinary and necessary expenses can add up to big tax deductions and savings as a business owner. It is important to know what qualifies, how to document, and how to plan alongside a tax strategist in order to save big each year during tax season. If you are ready to get started on your tax saving plan, give TSP Family Office a call today!

;)

;)

;)