To paraphrase Benjamin Franklin: Nothing can be certain except death and higher taxes!

The House Ways and Means Committee released a new tax proposal to help for $3.5 trillion in additional spending. The programs would be paid for through additional taxes on higher-income individuals and pass-through businesses like partnerships, sole proprietorships, and S-corporations.

Among other details, the Committee’s proposed tax law changes include:

- Raising the top marginal income tax rate to 39.6%, up from 37%, which would apply to income over $400,000 for single and head of household filers and $450,000 for joint filers.

- Tax long-term capital gains and qualified dividends at 25% for taxpayers with income above $400,000 for those filing single or $450,000 for those married filing jointly.

- Apply a 3.8% net investment income tax (NIIT) to active pass-through business income above $400,000.

It’s no surprise that the Committee’s tax hike proposal is driving more interest in tax-advantaged retirement solutions like Roth IRAs and for a very good reason.

These tax savings strategies are even more important for you to consider now as a way of reducing the impact of the coming capital gains tax increases. Plus, it allows you to grow your money with tax-free or tax-deferred investment options.

As an example, if you are an investor who moves money into a Roth IRA, you will have to pay taxes up-front, but you could then make tax-free withdrawals forever as long as you are age 59 ½ or older and hold the account for more than five years.

So, if Biden’s tax plan becomes law, high-income investors could save a substantial amount of money by paying a lower tax rate now and reducing their future tax burden for many years to come.

Also, there are many benefits to establishing a Roth IRA over and above the advantages you get with a traditional IRA. With a Roth IRA, you make after-tax contributions.

You also have the ability to continue contributing new retirement savings past age 72, unlike traditional IRAs, as long as you have earned income. Then you’re able to withdraw your contributions tax- and penalty-free at any time.

And if you need the money back for your business or any other purpose you are able to withdraw your Roth IRA contributions tax-free and penalty-free at any time and for any reason, unlike the restrictions on traditional IRA withdrawals.

Perhaps the most valuable benefit of all for estate planning purposes, your beneficiaries can inherit your Roth IRA assets completely tax-free.

What’s more, there are even greater tax advantages that are possible by converting your traditional IRA to a Roth now.

The Tax-Savings Advantages of a Roth IRA Conversion

Another valuable strategy to consider is to convert your traditional IRA assets to a Roth IRA.

Anyone can do so, regardless of income or marital status. Prior to 2010, only those account owners who had a modified adjusted gross income below $100,000 were eligible to convert, but today everyone can consider this valuable tax-saving option.

Generally, money converted into a Roth IRA must remain there for at least 5 years to avoid penalties and taxes.

Distributions from a Roth IRA are tax-free and penalty-free provided that the 5-year aging requirement has been satisfied and you satisfy other basic conditions. You are free to move some or all of your traditional IRA assets into a Roth IRA.

And while there are contribution limits for Roth IRAs, there are NO limits on converting traditional IRA assets into Roth IRAs. The amount of money you convert will be taxed as income in the year of conversion.

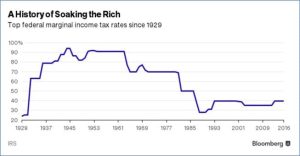

With a traditional IRA by contrast, you will be taxed later, perhaps at much higher tax rates in the future. With a Roth you’re taxed now, at individual tax rates that are currently the lowest in decades.

Is a Roth IRA Conversion Right for Me?

The three most import factors for you to consider when converting traditional IRA assets to a Roth IRA boils down to three simple things: costs, time, and especially taxes.

Here are three questions you should consider carefully before converting:

Costs: Because you are required to pay income taxes on your IRA conversion now, you’ll need to consider that upfront cost and have outside funds readily available.

Time: If you qualify, you can do an eligible rollover distribution from your old 401(k) directly to a Roth IRA. You’ll owe taxes on the amount of pretax assets you roll over.Generally, the older you are, the less you time you have to enjoy the benefits of tax-free compounding of your retirement nest egg. Conversions may not make as much sense if you have a short time horizon.

Taxes: Currently, the top marginal tax rate in the U.S. at 37% is the lowest it has been in our lifetime. Herein lies the opportunity to convert traditional assets to a Roth IRA.

In fact, there may never be a better time to consider converting your traditional IRA into a Roth IRA than right now.

Investment Flexibility with a Self-Directed Roth IRA

You are not locked into only investing in traditional assets like stocks, bonds, or mutual funds within your Roth IRA. There is a long list of alternative investments that are eligible too, including:

- Real Estate: Raw land, rental properties, real estate partnerships

- Private placements and privately held company stock

- Financial mortgages and notes

- Tax lien certificates

- Gold coins and even crypto currencies

To summarize, here are some of the key advantages of converting to a Roth IRA now:

Accumulate More Retirement Savings

A Roth IRA is always worth more than a traditional IRA that has the same balance because, if you follow the rules, you’ll never pay a dime in taxes when you withdraw your money, including no taxes paid on your compound earnings, unlike a traditional IRA.

Avoid Minimum Distributions

Unlike a traditional IRA, you won’t be forced to take distributions you don’t really need. Instead, you can allow your Roth IRA investments to grow tax free as long as you want.

Reduce Estate Tax

The estate tax applies to both traditional IRA and Roth IRA assets. There’s no way to avoid it. But, in a Roth IRA your heirs get to keep ALL the money they withdraw tax free.

Rate Shifting

If you convert to a Roth IRA now, while tax rates are at historic lows, you’ll pay tax now in a lower bracket. Later, when you take money out of your Roth IRA, you won’t pay any tax, avoiding potentially much higher rates that could apply at that time.

Flexibility

You have greater flexibility to withdraw your money from a Roth IRA before age 59 ½ without paying penalties. Five years after conversion, you can withdraw the conversion amount (plus any regular contributions, but not earnings).

Bottom line: As Ben Franklin said: the only things certain are death and taxes. And with the certainty of higher tax rates just ahead, you owe it to yourself to consider the many tax-saving and wealth-building advantages of the Roth IRA conversion. To learn more about the proposed tax changes, watch our webinar, The Proposed Tax Changes. To see how a Roth conversion could work for you, contact TSP Family Office at (772) 257-7888.

;)

;)

;)

;)

;)

;)

;)